Loading... Please wait...

Loading... Please wait...- Home

- Trucking Directories

-

Truckers News Feed

- Semi Truck Accidents News Reports

- Bus Accidents News Reports

- Current USA Diesel Fuel Prices

- Take Our Border Back Convoy News Coverage Live Streams Schedule Route Activities

- USA Real Time Road Conditions

- FMCSA DOT CDL News Regulations Enforcement Actions

- Trucking Companies Driver Scams Ripoffs Hiring Training Leasing

-

Video Library

- EXTREME Big Rig Truck Wrecks Crashes Accidents Videos

- Custom Big Rig Semi Truck Videos

- Tutorial Video National Registry Medical Examiner

- Big Rig Trucker Training Videos

- Heavy Haul Trucking Big Rig Videos

- FasterTrucks Road Train Videos

- Perils of Speed Limiters in Big Rig Trucks Videos

- Global Truckers Videos

-

Articles

- Top 50 Tips Every Truck Driver Should Know

- Truck Driver Safe Driving Rules

- Downsides of Driving a Truck in Winter

- How to Find a Truck Driving School

- Top 5 Characteristics Successful Truck Drivers

- Truck Driver Accident Procedures

- Owner Operator Tax Deductions

- DOT CDL Commercial Vehicle Inspection Procedures

- HOS New Hours of Service Rules FAQ Truckers

- SafetyPass Pro

- Search Trucking

- Contact Us

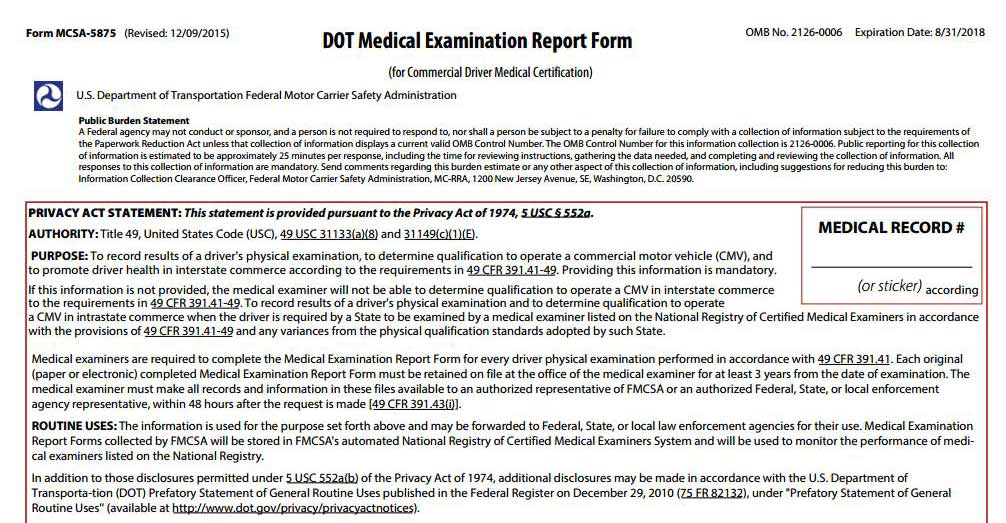

CDL Drivers DOT Medical Exam Form MCSA-5875 PDF

Current Form & Medical Card

Free to Print or Download.Big Rig Truckers Video Library

Videos from the road including Big Rig Truck Accidents, Wrecks and Crashes, Trucker Training Videos, Real Life Video about the Perils of Speed Governors in Big Rig Trucks, Road Train Videos and Global Trucker Videos.

Videos How To Chain Up Big Trucks Tire Chains Instructions

Videos - Learn How To Chain Up a Big Rig Semi Truck or 18 Wheeler. Experienced Truck Drivers Show You How to do it. Single Tire Chains and Double Tire Chains (Three-Railers) Installation Instructions.

Truck Driver Safe Driving Rules

Best Safe Driving Tips for Truck Drivers. Watch Videos, See what happens when safe driving rules are violated.

DOT Truck Inspection Procedures

North American Standard Level I DOT Inspection Procedures.

- Home

- Truckers News Feed

- Trucking Companies Driver Scams Ripoffs Hiring Training Leasing

News Reports Articles Trucking Updated | Semi Truck Accidents News Reports | Bus Accidents Crash News Reports | EXTREME Videos Big Rig Truck Wrecks Crashes Accidents | Truck Driver Safe Driving Rules | USA Real Time Road Conditions | RoadCheck Commercial Vehicle Inspection Procedures | Trucking Company Truck Driver Scams Ripoffs

Trucking Companies Driver Scams Ripoffs Hiring Training Leasing

Recent Trucking Scams News

View News Reports Below.

Includes Truck Driver Training Scams Dishonesty and Misrepresentation. Updated frequently to bring you the latest information and news on Truck Driver Training, Hiring and Truck Lease-Purchase Scams/Ripoffs as reported by the victims.

Most Popular Scams

Deceptive, Misleading Statements made by Trucking Company Recruiter's (professional sales people) designed to entice New (un-aware) Truck Drivers into signing loan documents for Truck Driver Training costs which are several times the reasonable amount for legitimate truck driver training such as found at Community Colleges.

They paint a pretty picture. The world is promised to you. Unscrupulous trucking companies and training schools run drivers through like cattle. This is called the "CDL Mill Scam". They prey upon those with poor credit and encourage co-signors. Those with Military educational benefits or Pell grants are especially at risk.

Drivers are then forced to quit after a short period of time. Their miles are cut or they are fired for the slightest infraction in order to make power units (trucks) available to new students. These dastardly actions keep the scam volume high.

Trucking Company Lease Purchase Programs

These programs are designed to screw the unsuspecting new truck driver. At $4.00 per Gallon for diesel, it costs approximately $1.35 per mile in total expenses to run a semi-truck. Keep this figure in mind before signing any owner/operator truck-leasing-purchase-agreement.

Speed Limiters Cap a Truck Drivers Income

Since most drivers are paid by the mile and NOT by the hour speed governors limit the total miles you can travel within your mandated driving hours. Truck Speed Limiters also cause undue stress and fatigue. Speed Limiters make drivers want to quit. Speed Limiters only benefit the trucking company's bottom line profits while endangering the truck driver and the motoring public.

See Speed Governor Videos - Click Here

Tips: Avoid Truck Driver Training Scams

Look for truck driver training schools that have some form of accreditation, such as Community Colleges. Never Take the word of trucking company recruiters. Do your Homework and calculate your expenses carefully before making any financial commitments. "Never Expect What You Don't Inspect First"

This Trucking Company Scams News Blog is part of the Truckers News Feed Published by FasterTruck.com

02/21/26 - Rookie Truck Driver Screws Up | Bonehead Truckers

Fastertruck News - 02/21/26 - 02:47:10pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/21/26 - USDOT Announcement On Trucking Schools and Foreign Truck Drivers | Full Press Conference

Fastertruck News - 02/21/26 - 12:45:17am -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/20/26 - USDOT ANNOUNCMENT | LIVE REACTION

Fastertruck News - 02/20/26 - 08:43:49pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/19/26 - Illegal Truck Driver Runs Over American In Avon Indiana

Fastertruck News - 02/19/26 - 07:46:32pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/19/26 - NBC News CRASHES OUT Over Foreign Truck Drivers

Fastertruck News - 02/19/26 - 08:50:23am -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/18/26 - Foreign Truck Driver Stuck Cuz He Can't Read English | Bonehead Truckers of the Week

Fastertruck News - 02/18/26 - 02:39:52pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/16/26 - DASHCAM RELEASED! Indiana Wreck Involving Amish and Truck Driver

Fastertruck News - 02/16/26 - 06:42:50pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/15/26 - Foreigners BUSTED at a Truck Stop | Bonehead Truckers

Fastertruck News - 02/15/26 - 02:17:54pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

Fastertruck News - 02/13/26 - 04:06:36pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/12/26 - EPIC TRUCK FAILS & BAD DRIVERS | Vol 8

Fastertruck News - 02/12/26 - 06:27:48pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/11/26 - Bonehead Truckers of the Week | Don't be Swift Transportation

Fastertruck News - 02/11/26 - 02:19:42pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/09/26 - Are Paper Logs Coming Back For Truck Drivers? | Breaking News

Fastertruck News - 02/09/26 - 09:58:54pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/08/26 - Prime Inc Driver Get CALLED OUT! | Bonehead Truckers

Fastertruck News - 02/08/26 - 02:51:36pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/05/26 - Foreign Trucking Company DECLARES WAR on American Trucking | Sam Express | Tutash

Fastertruck News - 02/05/26 - 11:48:07pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/05/26 - Illegal Foreign Truck Driver Runs Over Amish Family

Fastertruck News - 02/05/26 - 02:49:37pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/04/26 - Swift is Best In Crash | Bonehead Truckers of the Week

Fastertruck News - 02/04/26 - 02:55:06pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/03/26 - BREAKING NEWS | 65,000 Foreigners Allowed into Trucking

Fastertruck News - 02/03/26 - 06:56:12pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/03/26 - SPECIAL REPORT | Foreign Trucking Companies EXPOSED | WFAA Reaction

Fastertruck News - 02/03/26 - 02:57:05pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________

Hey Owner Operators & Company Drivers!

Looking For A Great Company To Drive For

Lets Talk About It

Cameron Harris

TRC Freight & Reed Transport

423-275-6041

http://www.trcandme.com

Link To Apply For TRC Freight Owner Ops

https://intelliapp.driverapponline.com/c/trcandme?uri_b=ia_trcandme_1229324523

Company Drivers

https://intelliapp.driverapponline.com/c/reedtransport?uri_b=ia_reedtransport_635088677

___________________________________

Fuel Discounts & Factoring!

Save money on fuel and same day funding with NO hidden fees!

Click my link for more information!

https://www.rtsinc.com/agent-company/bonehead-truckers

___________________________________

SAVE $$$ at TruckStop.com

20% off for 6 MONTHS!!!

To recieve this promotion, click this link:

https://partners.truckstop.com/cp6eynpbnc8i

___________________________________

Save 10% off on Blue Tiger products! Click this "special link" and SAVE!!!

Click here --- https://bluetigerusa.com/?ref=ikestephens

Enter discount code: IS021422

Blue Tiger has the best headsets on the market, in my opinion. I have been loyal to Blue Tiger since I bought my first Blue Tiger headset in 2016. They have comfort to wear all day long. The quality of the sound is unbeatable. Their customer service is top notch.

Enter discount code: IS021422

10% Discount Link: https://bluetigerusa.com/?ref=ikestephens

___________________________________

Bonehead Truckers® has shirts and stuff! Check them out!

https://teespring.com/stores/bonehead-truckers

___________________________________

Our official website:

http://boneheadtruckers.com

___________________________________

Bonehead Truckers® of the Week every Wednesday!!

Send clips to contact@boneheadtruckers.com

___________________________________

Fan mail? Hate mail? Send them here!

Bonehead Truckers®

P.O. Box 1856

Waskom, Texas 75692

___________________________________

This video is protected by Fair Use in Copyright Law.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

___________________________________

My name is Ike Stephens. I started driving a truck in 2002. I started making trucking videos in 2010. I've done everything from VLOGs to parodies.

Trucker Rag Chew | Trucker Rag Chew is mixture of Vlog, music, and opinion. It is one of the original VLOG style videos series in the YouTube Trucking genre.

Bonehead Truckers® | I am one of only people who will call out the bad things truckers do to ruin this industry. Bonehead Truckers® exposes the bad behavior of truck drivers.

Trucking Advice | Mixed is into the normal videos, I have been known to put out an occasional educational video. Even though I still have a lot to learn myself, the things I do talk about is stuff I've learned the hard way.

YouTube Live | I was one of the original content creators to do live content. I started on Ustream and when YouTube started the live interactive content, I was one of the first to participate.

For business inquiries, contact by email.

contact@boneheadtruckers.com

If you would like to support this channel, the cashapp is:

@ike73

Bonehead Truckers Facebook Group

https://www.facebook.com/groups/boneheadtruckersoftheweek/

Bonehead Truckers® is a registered trademark of Isaac L Stephens

#trucking #fail #comedy

02/02/26 - Ban Foreign Truck Drivers or We're Coming to Washington DC

Fastertruck News - 02/02/26 - 06:00:26pm -

Get your Bonehead Truckers T-Shirts at:

http://www.boneheadtruckers.com

___________________________________